A conversation with Miguel Palacios on the convergence between finance and aesthetics. By José Luis Falconi

Although certain psychologists’ perspectives might differ, those of us trained in aesthetical theory know that one of the most intimate and seminal relationships for a human being is the one between the artist and his or her materials. If the rapport is fruitful and prolonged (it usually is), each will end up defining at least a significant part of the other.

In fact, it is the only relation that really matters when one tries to explain how art making might differ from other human activities: it is only through the quality of the artist’s intentional transformation of the materials that one might be able to recognize a work as “art” and assess its merits as such. Transforming materials in novel ways is tantamount to pushing boundaries in art: if something distinguishes the practice of the artist from the artisan it is the imperative of the former to transform his or her materials always in a “defamiliarizing” way–to use the technical term of the Russian formalists.

It is precisely in this continuous push for novel transformation that almost everything in the aesthetic field resides: it is over this fundamental relation that we claim the revolutionary potential of art and of artistic production (Benjamin, Lukács dixit) or its capacity to mold new types of subjectivities (Lacan, Foucault), which will end up spurring new social relations and new (and better) societies (Bloch, Brecht, and lately Rancière, and even Bourriaud). The individual’s constant negotiation with material—sometimes to the point of its own exhaustion—seems to shape subjectivity to its core.

Santiago Montoya’s “Improbable Landscapes”—the second iteration of his continuing project on finance and art, aptly entitled “The Great Swindle”—is perhaps the most overt, paradigmatic example of the way in which the perpetual relation between the material and the artist can open avenues of expression that are as unexpected as refreshing. If there is a probable landscape depicted throughout the show, it is that of the artist and his relation with his materials –Montoya, as we know, has worked with paper money for the last seven or eight years.

Thus, although most of the pieces included in Montoya’s 2012 exhibition, The Great Swindle—also at the Halcyon Gallery, London—were also based on paper money (i.e. the works were literally crafted out of paper currency), Montoya was more interested then in the propaganda aspect—made palpable by the imagery on the money’s surface—than in anything else. This, of course, didn’t mean that it was a superficial relation, but that the artist was focused on revealing one unique aspect of the multifaceted, multilayered relation that we have with our financial system: the gulf between official state propaganda and reality itself. For that reason, when efficient, those works ended up revealing how thin the veil of ideology has been stretched in certain contexts –the more suspect the state, the more pronounced the propaganda factor embedded in its own bills.

Nonetheless, as Montoya continued working with bills (cutting them, stretching them, altering them), he discovered their added value beyond their surface–first as canvas and then as raw material itself.

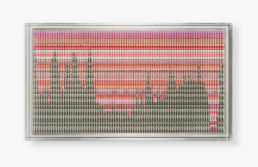

And it has been this development in the relation between artist and material (or discovery, as some might prefer to call it) that has yielded a new expressive dimension in Montoya’s work: by realizing that the bill itself, could be used to depict through its most basic material conditions, Montoya gained the possibility of not only exposing the bight between propaganda and reality but, more crucially, to expose how engulfed by the financial system we find ourselves at the present moment. Take for example the complete series of his “Horizons” (pp. 26 and 30) including “Latitude” (p. 32), which offers a peek at the financial sublime through pure connotation: through the infinite repetition of bills Montoya is not depicting the financial system, but the impossibility of even grasping it. We stand in both awe and despair, overburdened by our limited sensorial capacities, unable to ever make sense of all that is going on in front of us. In other words: what is conveyed through abstraction is not the landscape itself—impossible to apprehend and tame into form—but the array of sensations associated with it.

But Montoya’s search didn’t end there. He continued to push on with the same material in an exhaustive attempt to depict the elusive financial sublime. And thus, he came up with “Tally Sticks,” (p. 96) a piece which might possibly be as close as any artist can get to making us feel the fragile geometry on which the whole financial system is based: it might look like a perfect shape, and in perfect shape, but every facet rests on the most elusive of fictions, and the most contingent of materials: paper money itself.

And strangely enough we can stand there, in the middle of the gallery, admiring the geometrical perfection of this “improbable landscape” in just the same way we contemplate our economic system: with the strange sensation, the intimate certainty, we should say, that it is going to collapse soon, very soon.

With the imminence of our financial collapse in mind, I sat with Miguel Palacios (Professor of Finance, Vanderbilt University) to have a conversation about Santiago Montoya’s latest work, and to ask him how an expert on the mechanisms of present day finance might perceive the powerful meditation between the intricate, slippery relation between finance and art that Montoya has put forth in “Improbable Landscapes.”

Falconi: Looking at Santiago’s work, it seems that there are two ways in which there is an added value here to the bills with which he works. The first one is through labor: there is a very clear amount of work done here. A painstakingly cumbersome process is evident in all of those pieces; it’s very complicated to construct them. So, there is labor in them, which adds value.

Palacios: I am not sure this is the best way of accounting for the value in Santiago’s work. It might be better to simply say that the added value comes from the pleasure the manipulation of these bills creates in the viewer. It’s not the work. It is the result of the work.

Falconi: Exactly. It could be really bad results, and then the labor would be really thrown away. That brings us to the second way of accounting for value that I had in mind: the aesthetic effect. The problem with that view is that we have nowhere to pin it, don’t you agree? What is that value of pleasure?

Palacios: It is completely subjective, as is the value of everything else! In the end, in terms of money, the value of pleasure is the amount of money someone would be willing to pay to look at the results from Santiago’s work. But we never get to observe this value directly, because people have many different reasons why they pay to look at Santiago’s work. One such reason is just being able to tell others “I have a work by Santiago and get to see it everyday, and you don’t.” Here the value of Santiago’s work is not the pleasure one derives from it, but the status it gives to the owner. Disentangling those two reasons, pleasure and status, is hard.

Falconi: Lets consider the transformation the bills have incurred in Santiago’s work—how does such transformation add value to them?

Palacios: Yes. Aristotle would be amazed. Santiago made something out of nothing –because he turned a bill of exchange into an object of art.

Falconi: What in the works of Santiago interests you? We were talking about the “Horizons” (pp. 26 and 30) for a while and the effect they have through their continuous repetition of bills, of endless bills placed into a horizon, into which your sight simply disappears. It constitutes a sort of “financial sublime.” There is so much money in any of those “Horizons” that our senses can’t ultimately make sense of it. With the “Horizons” you are basically peeking into the sublimity of the financial system—a system impossible to decode, made out of money that really means nothing, and is just simply a repetition of numbers and numbers and numbers and numbers impossible to make sense of as a whole. I don’t know if you would agree with that.

Palacios: I agree that probably no one can make sense (of this system) as a whole, yet individuals, institutions, and governments, make sense of their own little part: how much of those numbers belong to them. This point is a deep one: no one can make sense of the whole economy because no one has all the information. At best you have a diffuse idea of what is going on, but no one grasps everything. “Horizons” captures that idea. The consequences of not grasping everything are important; it was one of the central insights from the Austrian School of economics. It means top-down efforts to control the economy are doomed to fail.

Falconi: Now, I have this hunch that only a Colombian could have really come up with that. And you are Colombian too. I am always baffled by the amount of stories of caletas [hidden cash stashes] found in Colombia. But besides that, the point is, there is no country with folklore about money, not that I can think of. Except maybe the African countries.

I don’t know, I’ve not been there. But in Latin America… I mean maybe Argentina is another case because Argentina, as Niall Ferguson stated once, is the country with the most extensive financial history in the world.

Palacios: I think the idea could come out of any country that has experienced hyperinflation –even just high inflation—because someone who has lived through those situations understands clearly that the bill is just a convention.

Falconi: But you don’t think the stories about narcos (drug lords) being too cold and needing to burn the money in order to heat themselves provides an extra awareness of the ephemeral value of the bill? I will never forget seeing forty million dollars… I mean when they find some of those narcos and you see the pictures, the pile of money they have is sometimes the size of a building! Forty million dollars stacked in hundred dollar bills is crazy!

Palacios: You know there is a movie where someone does that, so I don’t think that is unique Colombian. I agree with the idea that a Colombian had the background to think of this.

But I don’t think it would have been only a Colombian. I think it would have been someone exposed to hyperinflation. […] In general, whenever inflation takes hold the convention of how much a given bill buys you breaks down. Thus, hyperinflation erodes trust in the bill, one doesn’t know what the bill can do for me. Eventually, it becomes almost worthless.

Falconi: There is also part of what Santiago does, at least in the early parts of the work, that has to do with a commentary on the “propaganda side” of the bills. And this position might be informed by living in a country in which the official propaganda is really devalued.

Palacios: Ultra devalued, so to speak. And the truth is that I personally would not have thought of Colombian bills as particularly ultra propagandistic ones, but Santiago clearly thought otherwise.

He understood the huge gulf between what is preached on the bills and the reality on the ground in his own country, and from there he could move to other bills from other countries. He helps us realize how far official propaganda goes: say Chinese currency portraying US technology as their own, or North Korean currency showing images of the happy peasants in the country.

José Luis Falconi is Fellow at the Department of History of Art and Architecture at Harvard University. He has contributed to several journals as writer, editor, and photographer, and has curated more than twenty exhibitions of work by emergent Latin American artists.

(This interview is an excerpt taken from The Great Swindle (2014) published in the UK by Halcyon Gallery)